Why Pune Investors Prefer SIPs Over Fixed Deposits in 2025

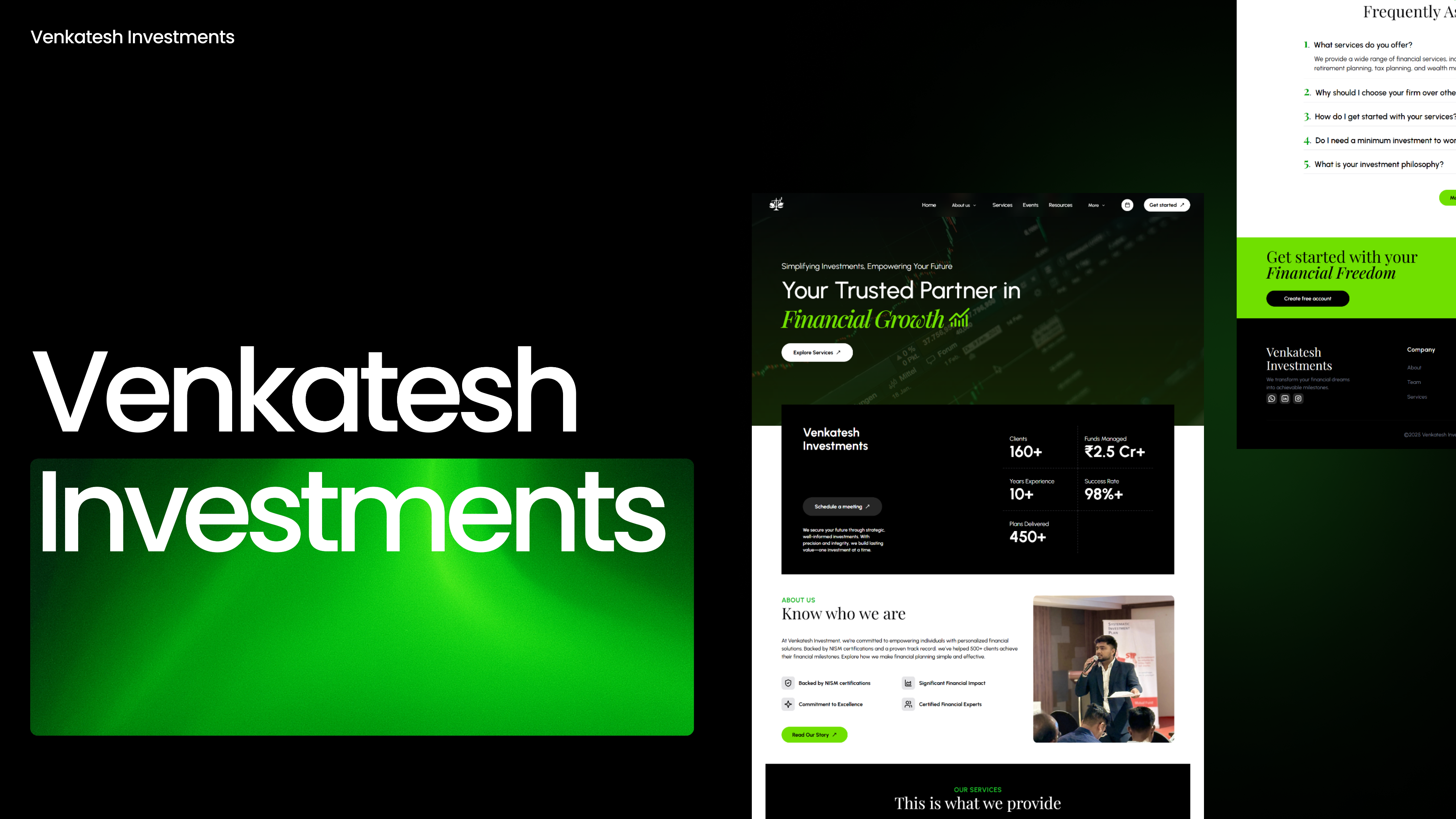

Venkatesh Investments

June 6, 2025

A Changing Financial Mindset in Pune

Over the past decade, Pune has transformed into one of India’s top financial hubs, driven by its booming IT sector, rising startup culture, and growing middle-class aspirations. With this evolution has come a noticeable change in how Punekars manage and grow their wealth.

In 2025, more investors in Pune are saying goodbye to traditional Fixed Deposits (FDs) and embracing the power of Systematic Investment Plans (SIPs). But why this shift? Let’s dive into the reasons driving this trend.

Fixed Deposits: Once a Favorite, Now Underwhelming

Fixed Deposits have long been considered the safest investment for Indian households. They offer predictable returns, are easy to open, and have been a go-to option for generations. However, in today’s inflationary environment, FDs no longer offer real growth.

With most banks offering around 6–7% annual returns, post-tax earnings often fail to beat inflation, especially for those in higher tax brackets. This means your money might be growing nominally, but losing purchasing power in real terms. For Pune’s upwardly mobile professionals, that’s a deal-breaker.

The Rise of SIPs Among Pune’s Young Professionals

A new generation of investors is reshaping the financial narrative. Tech employees in Hinjawadi, young couples in Kothrud, entrepreneurs in Baner, and freelancers across Viman Nagar are looking for smart, flexible, and goal-based investment options—and SIPs tick all the right boxes.

With SIPs, you don’t need to time the market or have a large corpus to start. Even a monthly investment of ₹500 or ₹1000 is enough to begin your wealth-building journey. The concept is simple: invest a fixed amount regularly into a mutual fund scheme, and let the power of compounding and rupee cost averaging work for you.

Why SIPs Are Winning in 2025

1. Better Long-Term Returns

SIPs, especially those invested in equity mutual funds, have historically delivered 10–14% CAGR over long periods. This makes them far superior to FDs, especially for long-term goals like children’s education, home buying, or retirement.

2. Flexible and Convenient

Unlike FDs that require a lump sum and penalize premature withdrawals, SIPs offer high liquidity and flexibility. You can pause, modify, or stop SIPs with ease. This suits the dynamic lifestyles of Pune residents who might switch jobs, start businesses, or travel often.

3. Tax Benefits and Efficiency

FD interest is taxed as per your income slab, making it inefficient for high earners. SIPs held over one year in equity funds enjoy Long-Term Capital Gains (LTCG) tax at just 10%, and up to ₹1 lakh gains per year are tax-free—a huge advantage for Pune’s high-income professionals.

4. Inflation-Adjusted Growth

In an economy where inflation eats away at fixed income, SIPs stand out by offering market-linked returns that can beat inflation. This ensures that your wealth not only grows, but retains its true value over time.

The Role of Local SIP Advisors in Pune

The rise of SIPs isn’t just about better returns—it’s also about better guidance. Investment advisors like Venkatesh Investments in Pune have played a key role in educating clients, simplifying investment platforms, and building trust.

Whether you’re a 24-year-old software developer in Aundh or a retired government employee in Sadashiv Peth, SIP advisors now offer customized planning—helping you align your investments with your lifestyle and goals.

Final Words: FDs Still Have a Place, But SIPs Build Wealth

Let’s be clear—Fixed Deposits still have a role to play in emergency planning and capital preservation. But for long-term goals, Pune investors are choosing SIPs because they offer growth, tax-efficiency, and flexibility—a perfect combination for today’s fast-paced world.

If you’re still relying only on FDs, it’s time to reconsider. Pune has already moved forward—and so should your portfolio.

Want to start a SIP or get a free portfolio review?

👉 Connect with Venkatesh Investments, your trusted Maharashtra SIP planner.

📍 Based in Pune | Serving across Maharashtra

📞 Call us today and begin your journey toward smart investing!