Top SIP Plans for IT Professionals in India

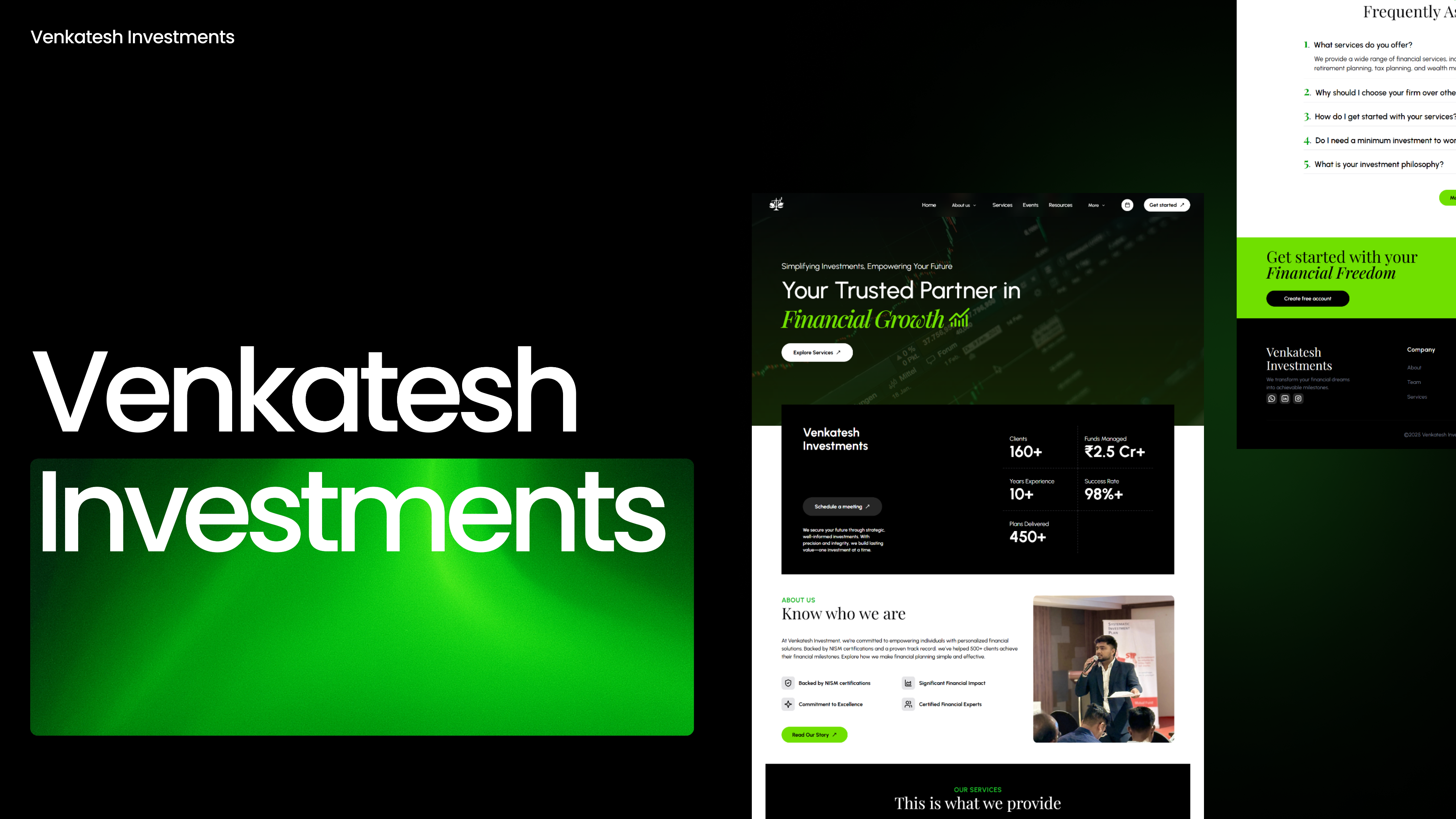

Venkatesh Investments

June 7, 2025

In the ever-evolving IT industry, where change is constant and career growth is rapid, financial planning often takes a back seat. But if you're a software developer in Bengaluru, a data analyst in Pune, or a tech lead in Hyderabad — the time to take control of your money is now. Systematic Investment Plans (SIPs) are one of the smartest, most disciplined ways for IT professionals to build wealth steadily.

Why SIPs Make Sense for IT Professionals

SIPs are a perfect fit for salaried IT employees because:

- Consistent Salary = Consistent Investment: Most IT jobs provide stable income, making monthly SIPs easy to automate.

- Tech Comfort = Digital Investing: You're already familiar with online tools, making SIP tracking and investing seamless.

- Early Start = Bigger Corpus: The earlier you begin, the more you benefit from compounding.

- Section 80C Tax Benefits: ELSS mutual funds under SIP help you reduce taxable income.

Whether you’re just starting out or earning a mid-level package, SIPs help align your tech income with long-term financial growth.

SIP Strategies Based on Career Stage

If you're in your 20s, focus on growth-oriented mutual funds like small-cap and mid-cap SIPs. These funds are more volatile but offer higher returns in the long run — a good fit for someone who can wait 10+ years.

For those in their 30s, consider diversifying across flexi-cap and multi-cap funds. These give you a blend of large and mid-sized companies, balancing growth and safety.

If you’re 40 or older, it’s time to dial down risk. Shift a portion of your SIPs into large-cap and hybrid funds, which provide stable growth and partial debt exposure.

To save tax at any age, ELSS funds via SIPs offer tax deductions under Section 80C with a 3-year lock-in — shorter than most tax-saving instruments.

Best SIP Mutual Funds for IT Professionals in 2025

Here are five top-performing SIP options widely recommended by financial advisors, including us at Venkatesh Investments:

1. Quant Small Cap Fund – Direct Plan Growth

Ideal for early-career professionals seeking aggressive long-term growth. It has shown strong performance over the last 5 years and benefits from India's small-cap momentum.

2. Parag Parikh Flexi Cap Fund – Direct Plan Growth

A great all-rounder for mid-career individuals. It offers global exposure and a solid track record with lower volatility.

3. Mirae Asset Tax Saver Fund – Direct Plan Growth

Perfect for those looking to save on taxes while still targeting good returns. With only a 3-year lock-in, it’s ideal for salaried IT employees.

4. HDFC Hybrid Equity Fund – Direct Plan Growth

Designed for professionals in senior roles or those approaching life milestones like home purchase or kids’ education. This fund mixes equity with debt, reducing risk.

5. Axis Bluechip Fund – Direct Plan Growth

Best suited for those seeking stability. Large-cap exposure helps preserve capital while offering reasonable growth.

Smart SIP Tips for Tech Professionals

- Start Early: Even ₹1,000/month can grow into a significant corpus over time.

- Set Clear Goals: Use SIPs to plan for retirement, child’s education, home, or early financial freedom.

- Automate Everything: Set up monthly deductions via UPI, bank ECS, or app-based platforms.

- Review Annually: The tech world evolves — so should your portfolio.

- Diversify Wisely: Don’t stick to just one fund or one category. Mix large-cap, flexi-cap, and tax-saving SIPs.

Why Choose Venkatesh Investments?

At Venkatesh Investments, we understand the unique financial journeys of IT professionals. Whether you’re in Pune, Mumbai, Gurugram, or remote from Nashik, we offer:

- Goal-based SIP Planning

- Annual Portfolio Reviews

- One-on-One Advisory Support

- Tax Saving Strategies for Salaried Employees

- End-to-End Digital Investment Setup

We are trusted by working professionals across Maharashtra and India who want to take control of their money without being overwhelmed by it.

Final Words

Being in IT gives you an edge — high earning potential, early career growth, and digital skills. Don’t let that advantage go to waste. SIPs are your tool to secure financial freedom, build wealth, and stay ahead of inflation.

Let Venkatesh Investments be your partner in creating a worry-free financial future.