Understanding Risk Profiles Before You Start Investing

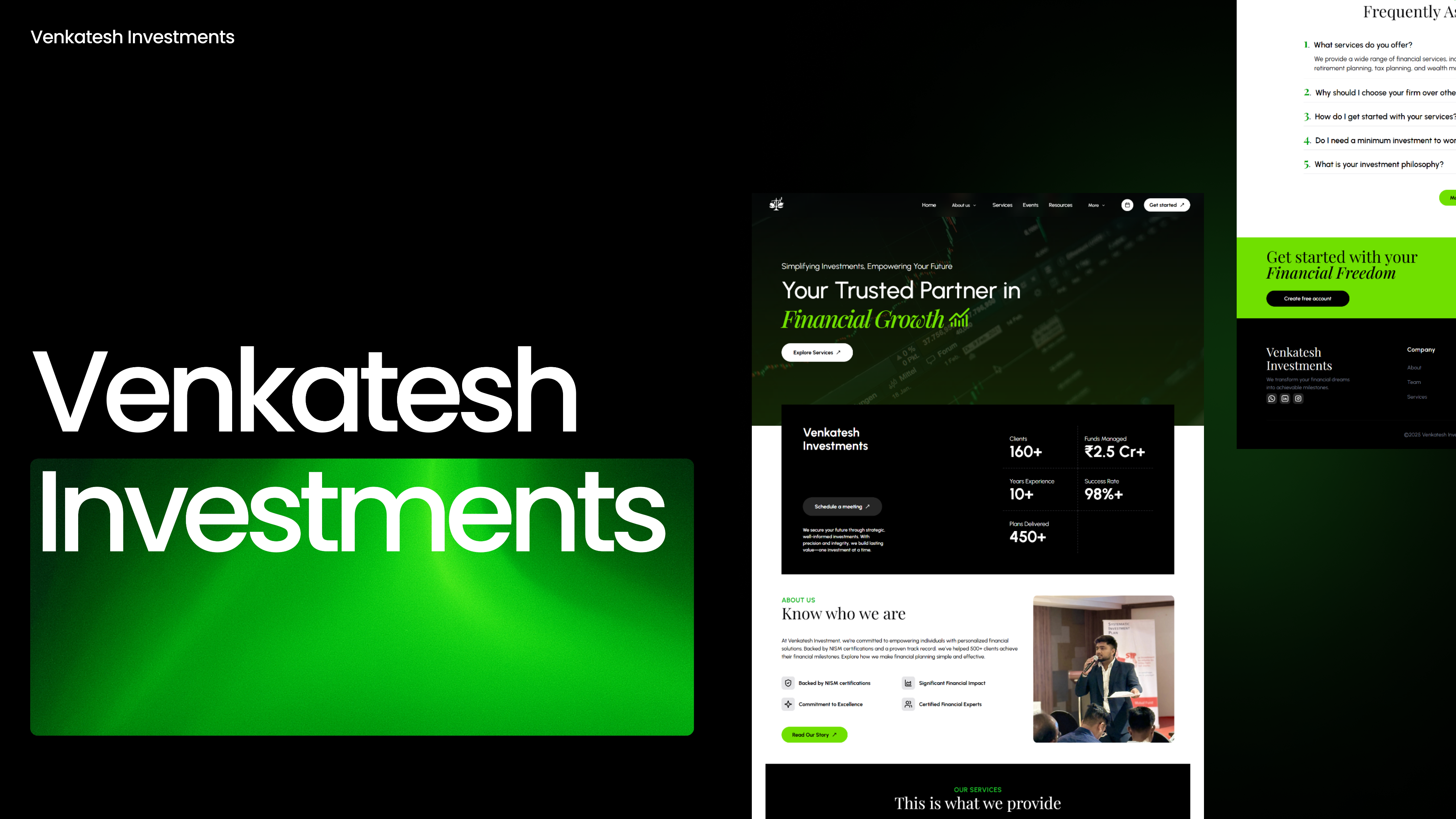

Venkatesh Investments

July 14, 2025

Before choosing where to invest your money, there’s one crucial step that most first-time investors ignore — understanding your risk profile.

At Venkatesh Investments, we make sure every investor starts their journey with the right strategy — not just popular advice.

This blog will help you understand what a risk profile is, why it matters, and how we help you choose investments that match your comfort level and goals.

What is a Risk Profile?

A risk profile tells us how much risk you are willing and able to take when investing your money. It depends on:

- Your age

- Your income and expenses

- Your financial goals

- Your investment experience

- Your emotional comfort with market ups and downs

Why It Matters

Not everyone should invest in the same mutual fund or SIP.

For example:

- A 25-year-old with no responsibilities might handle high-risk equity funds.

- A 55-year-old nearing retirement might need low-risk debt funds.

If you invest without knowing your risk profile, you may:

- Panic during market volatility

- Exit investments too early

- Miss out on long-term growth

The 3 Main Types of Risk Profiles

1. Conservative

- Prefers safety and capital protection

- Prioritizes fixed returns over high growth

- Best suited for: Senior citizens, retirees, people with low-risk appetite

2. Moderate

- Willing to take some risk for better returns

- Balances growth with stability

- Best suited for: Salaried professionals with medium-term goals

3. Aggressive

- Comfortable with market fluctuations

- Aims for high long-term growth

- Best suited for: Young investors, entrepreneurs, high-income earners

How Venkatesh Investments Helps You Identify the Right Profile

Most people don’t know where they fall on this scale — and that’s okay.

We guide you with a personal one-on-one consultation.

Here’s what we do:

- Understand your age, income, liabilities, and goals

- Ask simple, structured questions

- Explain what kind of investor you are (without technical terms)

- Recommend mutual funds and SIPs that fit you — not the crowd

Real-Life Scenarios We Handle

- A 30-year-old IT professional saving for a house

- A couple planning for their child’s education

- A freelancer with irregular income but long-term goals

- A retiree looking to earn monthly returns

Whatever your case, we help design a plan around your risk tolerance.

How to Get Started

Starting your investment journey the right way is simple:

- Visit www.venkateshinvestments.com

- Click on “Book Appointment”

- Choose a convenient time

- We’ll call or meet you and guide you through risk profiling and fund selection

Whether you’re in Pune, Delhi, Mumbai, Nagpur, or anywhere across India — we’re ready to help.

Why Choose Venkatesh Investments?

- Years of expertise in SIP and mutual fund advisory

- 100% personalized financial planning

- PAN India support — online and offline

- Transparent, jargon-free conversations

- Long-term partnership — not one-time advice

Final Words

Understanding your risk profile is not optional — it’s essential.

Start smart, invest confidently, and let us guide you every step of the way.