SIP Explained: A Simple Guide for First-Time Investors

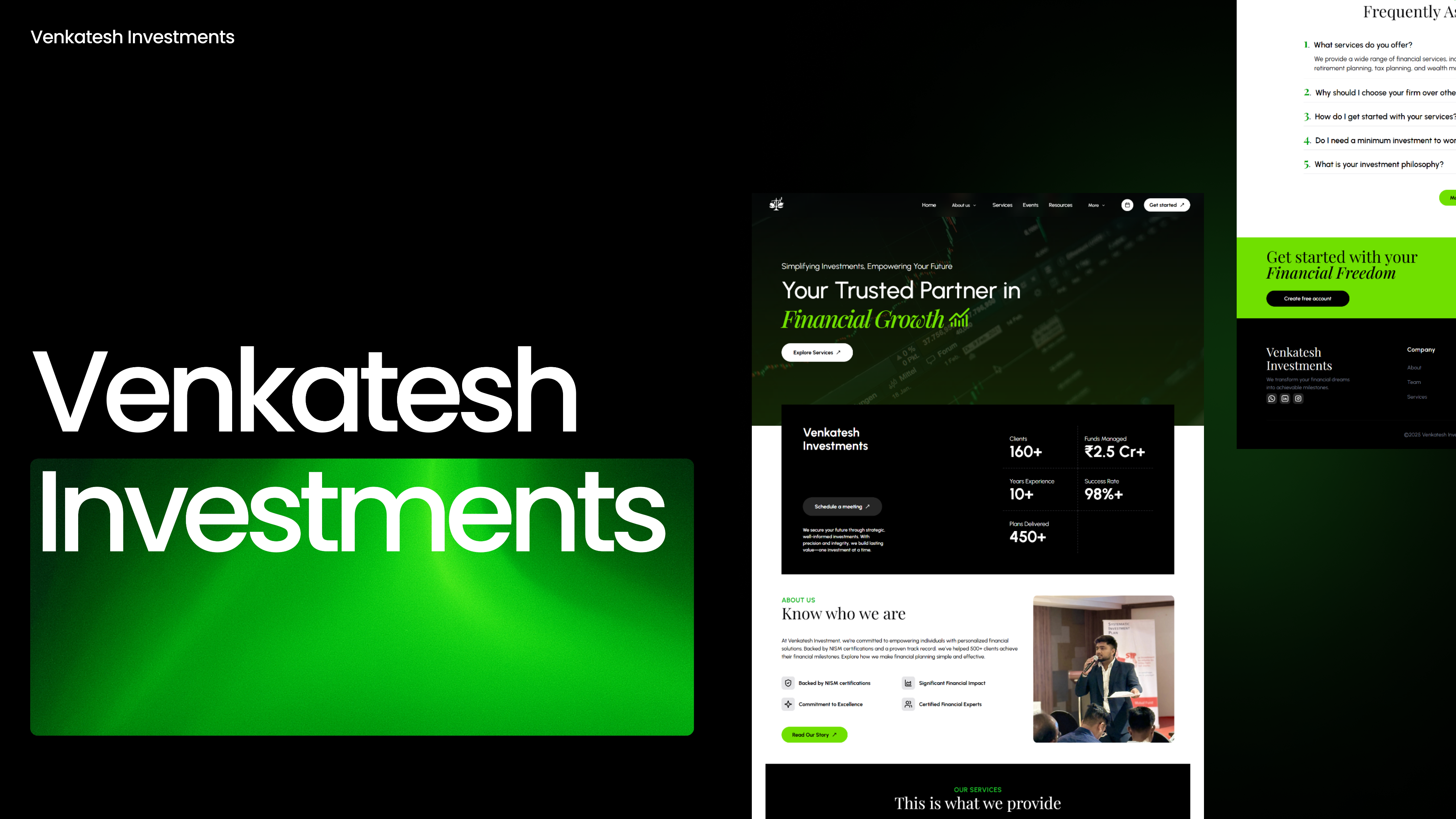

Venkatesh Investments

July 13, 2025

Starting your investment journey can feel overwhelming — but it doesn’t have to be. If you’ve never invested before, a Systematic Investment Plan (SIP) is the perfect place to start.

At Venkatesh Investments, we specialize in helping first-time investors across India begin their SIP journey with confidence and zero confusion.

This blog will explain SIPs in the simplest possible way — and if you still feel unsure, just book a free consultation with us and we’ll handle everything for you.

What is a SIP (Systematic Investment Plan)?

A Systematic Investment Plan (SIP) is a disciplined way to invest a fixed amount in mutual funds regularly — usually monthly or quarterly.

Instead of investing a lump sum all at once, SIP allows you to invest small amounts over time, helping you:

- Start with as little as ₹500/month

- Build wealth gradually

- Beat market volatility through rupee cost averaging

- Benefit from the power of compounding

How SIP Works — Simple Example

Let’s say you invest ₹2,000 every month through a SIP in a mutual fund.

Over time:

- You accumulate more units when the market is low

- Fewer units when the market is high

This averages out your cost per unit and lowers your risk — making SIP ideal for beginners.

Why First-Time Investors Should Start with SIP

SIPs are tailor-made for new investors. Here’s why:

- No need to time the market

- Automatic investments through your bank

- Flexible — start, pause, or increase anytime

- Affordable — perfect for salaried or self-employed individuals

- Long-term growth with professional fund management

Common Questions Answered

Is SIP safe?

Yes. SIPs invest in mutual funds that are regulated by SEBI and managed by AMCs (Asset Management Companies). Your money is handled by professionals.

Can I stop or withdraw SIP anytime?

Yes, SIPs are flexible. You can stop, pause, or withdraw funds partially or fully without penalties.

How much should I invest?

You can start with ₹500 per month. Over time, you can gradually increase your SIP as your income grows.

Don’t Know Which SIP is Right for You?

That’s exactly what we do at Venkatesh Investments.

Our expert advisors will:

- Understand your goals (education, home, retirement, etc.)

- Analyze your income and risk appetite

- Recommend the best SIP mutual fund

- Handle KYC and set up the SIP for you

You don’t need to fill any complex forms or study markets — we’ll do it all for you.

How to Get Started with Venkatesh Investments

It’s as easy as 4 simple steps:

- Go to www.venkateshinvestments.com

- Click on “Book Appointment”

- Choose a time that works for you

- Our advisor will guide you step-by-step and help you begin your SIP confidently

Why Choose Venkatesh Investments?

- Experienced SIP and Mutual Fund Advisor across India

- One-on-one personal guidance

- Online and paperless process

- Trusted by first-time investors in Pune, Mumbai, Delhi, and beyond

- No hidden charges or sales pressure

Final Words

You don’t need to be a finance expert to grow your money.

Start small. Stay consistent. Let us guide you.

📅 Book your free consultation today →

Let Venkatesh Investments help you start your SIP journey — stress-free and fully guided.